What is Bitcoin and How does it Work?

Here is a short 5 minute video which will give you an overview of what is Bitcoin. After that you can have a look at the rest of the article below for more details.

Bitcoin is a cryptocurrency – a peer-to-peer form of digital money that only exists virtually. As a result you can send it or receive it instantly and directly from another person or institution. It does away with using a bank or other intermediary which makes it decentralised.

As a result transacting peer-to-peer is a giant leap forward for computer science. We can transact directly with anyone around the world fairly instantly.

Most importantly because we finally have a currency that is native to the internet. So we will not just transfer information online like we used to. However we can also transfer value.

Who Issues Bitcoin

To clarify no country or central bank issues Bitcoin. Unlike sovereign fiat currencies like for example the Euro, Dollar, Russian Rubble etc. It was developed as an alternative to our current centralised banking system. Most importantly to improve on it and solve its inherent problems.

The way we can think of Bitcoin is as a borderless infrastructure. It is open to anyone that has an internet connection. Whether that person would like to own it or take part in the network in any other way.

As a result it is taking the control of money out of the hands of central bankers and politicians. It is like the separation of church and state. Except this is the separation of money from the state.

History

There were several companies that tried to create an electronic cash system in the 90s. They all ended up failing. However Satokshi Nakamoto sent out an email with the Bitcoin Whitepaper on the 31st October 2008. He sent it to a cryptography mailing list specifically to announce the creation of Bitcoin.

Satoshi Nakamoto is the creator of Bitcoin, but he remains anonymous to this day. There is a lot of speculation on who Satoshi is. However no one knows for sure who he is and whether he is an individual or a group of individuals.

Bitcoin Advantages

Before we get into how Bitcoin works it is important to cover some other things. Bitcoin was created to solve the problems in our current centralised banking system. The Bitcoin whitepaper states clearly that Bitcoin fixes:

- Fraudulent double spending – At times customers spend money twice when really there are no funds left in the bank. However Bitcoin has a ledger that goes through the history of transactions a person made on the network. It only considers the first transaction as the legitimate transaction. As a result it discards other transactions using the same coins. This eliminates fraud.

- Arbitration between merchant and customers – This is costly for banks and at times is an operation loss for them. Bitcoins transactions are irreversible and prevents merchants from fraud. On the other hand it also protects customers by using escrow mechanisms.

- Small transactions – these are an operation loss for banks. Bitcoin fees are low especially because of the lightning network.

Apart from the advantages mentioned in the whitepaper there are some other advantages to Bitcoin:

Peer-to-Peer

Centralised systems have one point of failure. If it breaks the entire system collapses. On the other hand a system that is more decentralised is more resilient and anti-fragile. Decentralised systems are quick to react to the weakest links which get compensated for or replaced.

Transparent

Bitcoin transactions are visible for everyone to see on its ledger. As a result anyone can verify that the ledger is honest and no fraud is taking place. It is virtually impossible for anyone to go about altering the transactions on the ledger. Moreover without others noticing it.

Secure

In Bitcoin’s case the network is very large. To clarify the larger the network gets the more secure it becomes. Bitcoin can suffer from a 51% attack. This kind of attack is where a malicious person/s gain control of 51% of the computers of the network.

As a result they corrupt the network in their favour. However the Bitcoin network is highly secure especially because Bitcoin is the largest cryptocurrency by market cap. In fact it is very expensive to mount an attack on it. So the likelihood of an attack happening is practically impossible.

Trustworthy

The ledger only records transactions once they are properly approved. Each transaction that occurs reinforces the previous ones. As a result it keeps making the sequence of transactions more legitimate and honest.

You do not need to have trust in third parties you make payments to. However you place your trust in the blockchain because all transactions are legitimate transactions.

How Bitcoin Works

Bitcoin uses a new type of technology called Blockchain. In short blockchain is an accounting ledger that records all the transactions that happen on the network. Similarly to what a bank does, but with different technology.

The transactions that are approved are included as blocks of transactions on a chain. Hence the name blockchain.

Before we get started on how Bitcoin works there are a couple of things to clarify. The network is made up of:

Miners

Miners, computers and nodes are words that are used interchangeably to refer to the same thing. They make an important contribution to the network as a whole.

Bitcoins are brought into circulation by mining, similarly to gold. Except miners do not need picks and shovels to mine it. That is to say miners use computer power to mine Bitcoin that is held by its blockchain.

Computers on the network set out to mine the blockchain. To win a Bitcoin reward they need to guess the right combination of numbers that will release the coins. Once they win the Bitcoin reward, miners can then distribute the Bitcoin to the network.

Additionally miners also approve the transactions on the network. Once they are approved they include them in blocks that they attached to the chain. The miners also keep the network secure.

Wallets

You can think of your wallet as your online vault similarly to your bank account. In other words a wallet has a wallet address like your bank account number or IBAN. This is also called a public key.

Bitcoin wallet addresses are alphanumeric and looks something like this: 3FZbgi29cpjq2GjdwV8eyHuJJnkLtktZc5.

Each wallet address or public key is unique. You can share your wallet address with third parties so they can send you Bitcoin.

On the other hand each wallet also has a secret seed which is also unique. A secret seed is also called a mnemonic phrase. The secret seed is usually made up of 12 or 24 words. It is your master password to your wallet funds.

You should never share your secret seed with anyone. Hence the word ‘secret’ in secret seed. Otherwise if you do other people will have access to your funds.

The blockchain produces a private key that is derived from your secret seed phrase. It is use when you send transactions. It is roughly the equivalent to a bank card PIN number.

As mentioned whatever you send or receive using your wallet address is recorded on the ledger. Most importantly you can see what you send by using either a hot wallet or hardware wallet. Here is an example of how it looks:

This image is cropped, but you get the idea. It will show you all your transaction history. So if you have many transactions you will need to scroll down through a longer list.

Hardware wallets are the best wallets you could use for storing your Bitcoin or any other cryptocurrency. This is because they are highly secure. You can check out hardware wallets here.

How Transactions Happen

When you make a payment with Bitcoin, the miners firstly check you have funds in your wallet address. They do this by checking your transaction history on the blockchain.

Additionally they also check something called a timestamp. Every transaction you make will have the time when you made the payment. This helps to ensure that you do not double spend funds.

If this happens then only the first transaction is considered the legitimate transaction. As a result only that transaction will go through.

Once miners see that everything is in order they approve the transaction. They make an announcement to the rest of the network that they approved the transaction. It usually takes around 10 minutes to get included into the blockchain.

Incentives for the Network

The reason why Bitcoin took off like it did is because it gives people incentives. Miners get rewarded for mining Bitcoin by collecting coins for their efforts. After that they can go and sell the crypto and get paid for their efforts.

The price of Bitcoin keeps going up which mostly keeps up with the cost of mining. Additionally miners usually make a profit from it which they can pocket. However if miners do not make a profit they could charge transaction fees. This applies even in the case where all the Bitcoin is eventually mined from the blockchain.

This will continue to incentivise the miners to mine. To clarify it will also compensate them for the electricity costs for them to maintain the network. Additionally, the network is continually being improved and upgraded as you can see in the implementation of the Taproot upgrade.

Bitcoin Disadvantages

Privacy

One disadvantage of Bitcoin is privacy. Anyone can see the transactions on the blockchain. Transparency is great, but there is a drawback to this.

You have to make sure that you do not tell people what your wallet address is. Otherwise they can look it up and see how much Bitcoin you have. Moreover they will see all your transaction history and which wallet addresses you transacted with.

There are ways of remaining anonymous. For example you could sort out and use a number of different wallets for different things.

However this will not help with institutions that survey the blockchain. With some additional information they can easily figure out who has what wallet address.

Criticism of Bitcoin

Power Consumption

Bitcoin has come under fire for its energy consumption. News outlets have criticised it and compared its energy consumption to that of small countries. Here in fact is an article on the BBC: Bitcoin consumes ‘more electricity than Argentina’.

However as we outlined in our article for Bitcoin Energy Consumption it is giving a skewed impression. Here is why:

- Firstly compared to gold mining and our monetary system, Bitcoin uses a fraction of the energy they consume. A monetary system needs power to function. Additionally everything consumes energy. The crypto community argue that this is a small price to pay for securing the network.

- Secondly a substantial portion of energy is coming from renewables.

- Bitcoin is still considered an emerging technology. As technologies improve and become more popular they become more efficient.

Criminality

Another critique of Bitcoin is that it is used by criminals online. This is true to an extent. However according to the Follow The Money Report by SWIFT, criminals still prefer cash for criminality and not cryptocurrency.

Since Bitcoin has a transparent ledger and is not private agencies like for example Chainalysis can track transactions. In fact law enforcement are using these tools to help them respond and crack down on crime.

The most notable is the couple that got arrested for hacking the Bitfinex exchange in 2016. They ended up stealing millions worth of cryptocurrency, but were arrested in February 2022. Here is the article on CNN business: Feds arrest a New York couple and seize $3.6 billion in stolen cryptocurrency.

Bitcoin Supply Limit

The Bitcoin supply limit is 21 million. This is set in stone in the source code of the blockchain. No one can ever go and mess with the code to change it. Check out Bitcoin vs Ripple to understand more about the importance of a limited supply.

Scarcity is a very important factor when it comes to sound money. It is one of the 6 characteristics that make money sound. In fact it is beneficial for society to have sound money for it to flourish. Hence why Bitcoin is celebrated.

“The simple things grow in value in proportion to their scarcity.”

Marty Rubin

Miners have already mined most of the Bitcoin from the blockchain. On the other hand over time miners will collect less Bitcoin rewards from the blocks. This is because of the Bitcoin halving which happens every 210,000 blocks or roughly every 4 years.

At this point in time the block rewards a miner receives gets cut down by half. In fact people estimate that all Bitcoins will end up mined by the year 2140. However with the increasing efficiency of mining computers this is likely not going to happen. Instead all the coins will get mined sooner rather than later.

Bitcoin is Backed By Nothing

There are some people that say: ‘Bitcoin is backed by nothing’. This is correct. However they say this because they think Bitcoin is worthless. However it is not worthless. Otherwise it would not keep going up in value.

If we use the same measure we can also say that sovereign fiat currencies are also not valuable. This is because they are also backed by nothing. To clarify what makes fiat valuable is the confidence in the currency itself. That is it.

There are several reasons why Bitcoin has value. At the end of the day money has to fulfil certain functions and characteristics. Moreover it has to provide additional value to society. So although Bitcoin is not backed by anything it is a better form of money than fiat. You can read in detail about what makes Bitcoin valuable.

Physical Bitcoin

Some people think that they can buy physical Bitcoin. This is because they see Bitcoins represented in an image similarly to the ones found on Amazon below.

However this is not the case. Bitcoin exists solely online. It is a virtual currency and there is no cash equivalent. Additionally Bitcoin Cash is not Bitcoin in cash, it is a different cryptocurrency to Bitcoin.

Bitcoin Adoption

At the start Bitcoin was collected by a small group. After some time however people seemed to keep it as a store of value. The price has gone up and down a lot, but on the whole it has steadily increased.

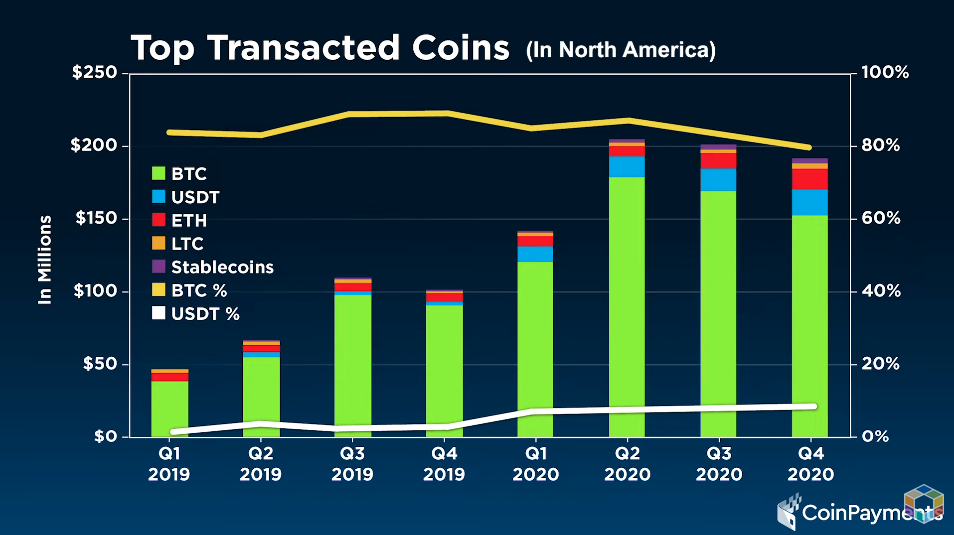

Now it looks like it people are transacting with it. This is according to the world’s largest crypto payment processor CoinPayments. They published an internal report for all of 2019 and 2020. Statistics are showing us that cryptocurrencies in general have had a 300% increase in use in the North American market.

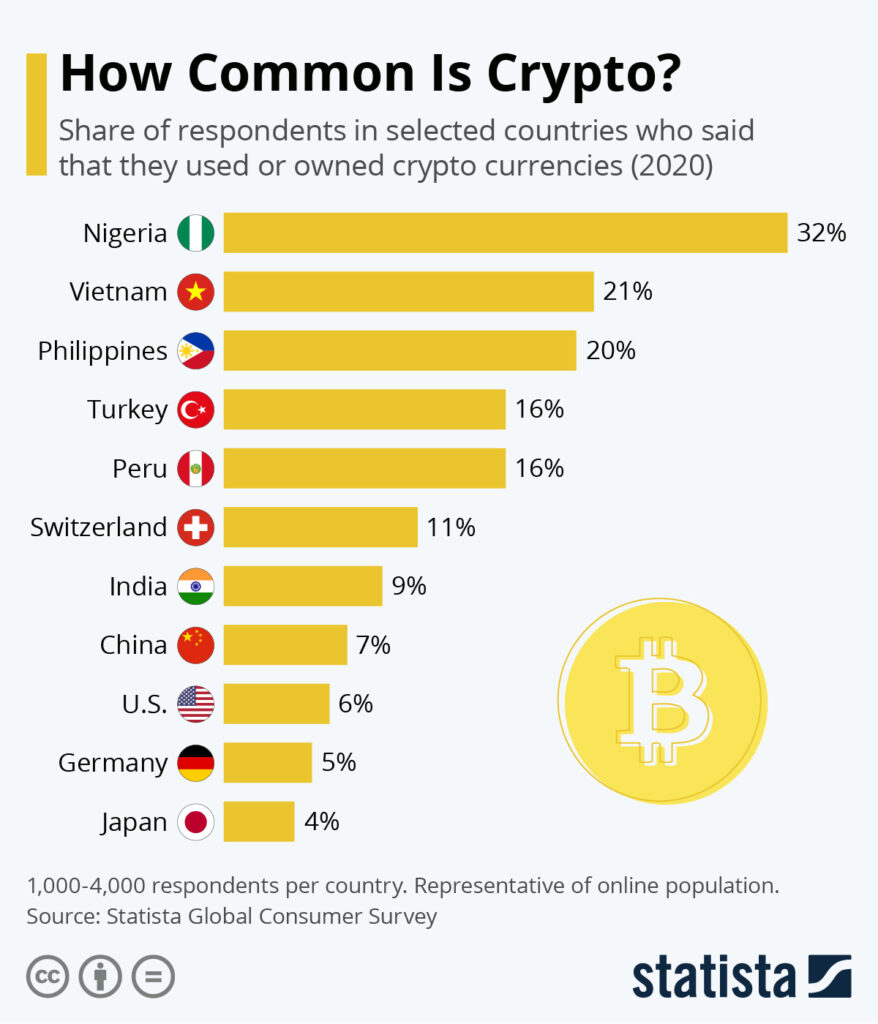

There is also data from Statista mentioning the use or ownership of cryptocurrency is increasing worldwide. Nigeria beats any other country with 32% use and ownership. However other countries are catching on.

Bitcoin Units of Account

Bitcoin is not just made up of full coins. However it is made up of smaller denominations. It supports up to 8 numbers behind the decimal point.

The smallest unit of Bitcoin is a Satoshi or Sat for short. In other words 1 Sat is 0.00000001 BTC. There is a crypto slang phrase that mentions Sats which you may have heard: ‘keep on stacking Sats’. When a person says this they mean you should continue to accumulate Bitcoin.

You can have a look at Bitcoin units here to learn what each unit is called.

How to Buy Bitcoin

Since Bitcoin can go down to smaller denominations you do not have to buy a full Bitcoin. However you can buy as little as $100 or less. It would depend on the deposit minimum limit of the cryptocurrency exchange.

If you are looking to buy Bitcoin you have a number of options. There are direct ways and indirect ways of owning Bitcoin. You can check out all your options on where and how to buy Bitcoin here.

Bitcoin Books

There are many Bitcoin books you can read. The best rated books are listed on our cryptocurrency books page. Here you will find Bitcoin, blockchain and general cryptocurrency books. The best book you could read about Bitcoin is The Bitcoin Standard.

The Bitcoin Standard

This books goes through the history of money. Most importantly because it will help you understand why Bitcoin is such a great innovation in money.